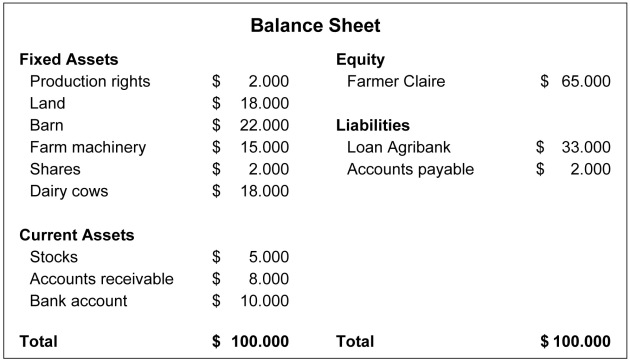

Balance sheet

A balance sheet is a ‘snapshot' of the value of the total value of a company on an given moment (usually presented on the left side) and on the right sight how this is financed. Both sides must be in ‘balance'.

These items are presented is in a regular order, whereby the order of liquidity of the items the way is to order the items on the balance. The format used in most Anglican countries is to put the most liquid item (cash) on top. In most European (related) countries it is the other way around.

Complement :

Reading Tip: http://en.wikipedia.org/wiki/Balance_sheet

Assets

To produce goods and/or services an enterprise requires resources. These resources owned by the company are called assets. The value representing these assets can be found on a balance sheet. Examples of assets in a dairy farm are land, machinery and cattle. But also roughage in stock, debtors and cash. The value representing the assets is equal to the value representing the liabilities.

Fixed assets

The part of the assets with a lifetime longer than a year are called fixed assets. Within the fixed assets intangible and tangible assets are distinguished. Examples of fixed assets are production rights, buildings, machinery and cattle.

Intangible assets

Intangible assets are those fixed assets which doesn't have a physical appearance and are sometimes difficult to value. Examples of these intangible assets are production rights or paid goodwill.

Tangible assets

The tangible assets are those fixed assets which have a physical appearance.

Current assets

The part of the assets with a lifetime shorter than a year are called current assets. Examples of these current assets are feed in stock, money to be received from debtors and money in cash.

Own equity

Own equity expresses the difference between assets and liabilities. In case of the liquidation of a enterprise. This is the amount of money with remains when all assets are sold and financial obligations are reimbursed. In other words, own equity is the capital in the firm which belongs to the entrepreneur or shareholders.

Liabilities

An enterprise needs money to finance the assets. In a balance sheet this can be found under the liabilities. Within liabilities the Own Equity, Long term Liabilities and Short term liabilities can be determined. The value representing the liabilities is equal to the value representing the assets.

Long term liabilities

Long term liabilities represent the long term financial obligations to finance the (fixed)assets. For example: loans from a bank or family members.

Short term liabilities

Short term liabilities represent the short term financial obligations to finance the (current)assets. For example a bank overdraft or the money still to be payed to creditors.

Solvency

Solvency is a rate which expresses how much % of a businesses is really yours. To calculate this number you divide the own equity with the total of the balance sheet. In the example the solvency is 65%.

Method :

Google for two or three annual reports of a well-known company and look if you understand the presented balance sheet (make a print of the pages with the balance sheets).

Make your own personal balance sheet in excel and calculate your own equity.

Take these exercises with you for the first lesson.